Articles

| Name | Author | |

|---|---|---|

| Fair billing – realizing profits from each line maintenance job | View article | |

| The World according to IT & Me! | View article | |

| Case Study: Managing a Dynamic Engineering Environment in Indonesia | Ananta Widjaja, Technical Director, Sriwijaya Air | View article |

| Fleet Utilization Optimization | Dr. Nima Safaei, Senior Specialist – Risk and Reliability Analysis, Bombardier Aerospace | View article |

| Digital aircraft and engine lease returns | Tim Scott, Vice President Technical Services, AVITAS | View article |

Fair billing – realizing profits from each line maintenance job

Author:

Subscribe

Fair billing – realizing profits from each line maintenance job

Saravanan Rajarajan. S, Principal Consultant with Aviation Practice, Ramco Systems asks, can line maintenance MROs increase their profitability by dealing with revenue leakage?

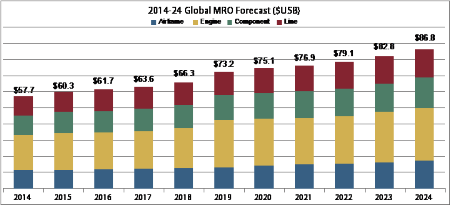

2014-24 global MRO forecast ($USD)

According to industry forecasts, in the next 10 Years, MRO growth globally will account for USD 86.8 Billion. Line maintenance is predicted to account for 20% of that with a CAGR (compound annual growth rate) of 4.1% (Ref Fig 1 below). It is expected that, a significant proportion of this 20% will be outsourced to line maintenance MRO service providers, allowing carriers (airlines and aircraft operators) to focus on their core activities. As carriers continue to reduce the cost of maintenance, are there opportunities for a ‘line maintenance’ MRO to still increase profitability by reducing levels of or eliminating revenue leakage?

Source: TeamSAI 2014-25 Global MRO Forecast

Challenges faced by line maintenance MROs

Being the highest priority for airlines and aircraft operators, line maintenance is the last process to be outsourced after engine/APU (auxiliary power unit) maintenance, components, and base maintenance. Both network and low cost carriers expect line maintenance MROs to adhere to strict SLA (service level agreement) clause with penalties for any service level deviation. As carriers look to achieving maintenance cost reduction, MROs are expected to generate savings and this, in turn, squeezes the profitability of those MROs.

As Independent service providers serving multiple carriers, line maintenance MROs are required to attain multiple certifications across multiple regulators according to different customers’ countries and the jurisdictions in which they operate. In addition, line maintenance MROs have to ensure the availability of technical crew with the valid regulatory licenses for flight release, MEL (minimum equipment list) clearances and round the clock AOG (aircraft on ground) support.

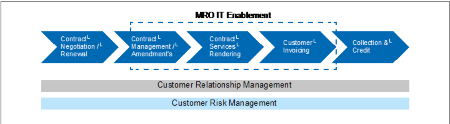

Line maintenance MRO revenue chain

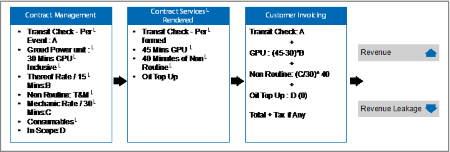

A typical revenue chain for a line MRO/FBO (fixed base operator) is depicted in Fig: 2 below. Every link in the chain is critical for the purposes of controlling revenue leakage. Hence, every stage of the process, if not managed properly, has the potential to lead to revenue leakage from the chain. For example, improper setup of contract inclusions and exclusions; wording of part thereof clauses; inaccurate recording of the ‘activity performed on the Aircraft’… all of these can lead to ‘post facto’ reconciliation requirements or missed revenue. In this article we are specifically looking into the key MRO activities between signing the contract and invoicing the customer.

Fig 2: Line Maintenance MRO Revenue Chain

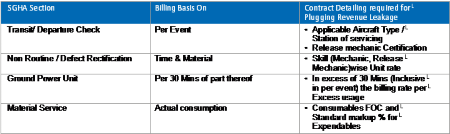

Contract management / amendments

To a considerable extent, IATA’s Standard Ground Handling Agreement (SGHA) guidelines help carriers and line maintenance MRO service providers to get the contract paper work done faster. However each customer contract may have variances in the form of inclusions, exclusions, billing policies, etc. The table Tab 1 (below the end of this section) highlights the SGHA sections and possible variances of contracts clauses. A few of the services more commonly addressed in a third party MRO or line management contract and some guidance on how to charge for them are set out below – based on the IATA guidelines.

Transit / departure checks, daily check maintenance services and ‘A’ check services respectively

Billing can be based on ‘Power By the Hour’ (PBH) for major/ captive customers; as a fixed price per event or purely T&M (time & material) for ad hoc / non-contracted customers.

AOG support services

Charge for time & material with a part thereof clause for ‘per man hour’ or ‘per man day’ calculations.

Wheels services and brake assembly

Bill at the standard rate for (contracted part # only) replacement or overhaul, with the inclusion of clauses on consumables and expendables, plus agreed labor hours and rates. Adhoc service rates for FOD (foreign object damage) rectification for labor, NDT (non-destructive testing), and materials.

Battery services

Charge at the standard rate for periodic, regular and general overhaul with a clause on logistics.

Engine change

Rates and charges for specified engine type, station, agreed TAT (turn-around times), scheduled/ unscheduled change with inclusion clause for expendables, consumables, tools and agreed rates. Additional work rates and part thereof clause.

Warehousing services

Standard rates per month with agreed floor area in respective station. Additional storage space recharges rates. Exclusion of part # list engines and APU’s: insurance and loss clauses.

Additional support

T&M rates for out of scope services like maintenance planning document (MPD), service bulletins (SB) and non-routine tasks.

Ground equipment support

Charge at standard and part thereof rates for agreed units of measurement (per service, per event, per hour) for equipment such as GPU (ground power unit), air starter unit, push back, a/c unit, nitrogen cart, lavatory service, potable water

service, etc. Inclusion clause as part of fixed price package and part thereof rates to be recharged to the carrier.

Materials Support

Charge a standard mark-up percentage for consumables and expendables provided by MRO contractor. Inclusion clause for consumables in fixed price package or recharged to carrier.

The application of an appropriate MRO IT system can help in maintaining the contracts with work scope, fleet, service location, inclusions, exclusions, standard rates and part thereof rates. MROs also need to maintain the current rates by considering the escalation charges agreed as part of SGHA. This will ensure the services rendered are always billed at the appropriate rates.

A typical case of narrow body transit service along with ground handling is depicted in the table Tab 1 (below) with reference to SGHA sections. The more flexibility and detailing of contract set up that is incorporated in the MRO IT system, the less will be the revenue leakage for the services rendered.

Tab 1: Detailing of contract set up in MRO IT system

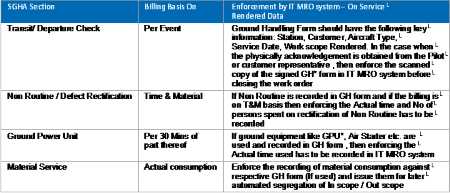

Rendering of contract services

Recording of actual services rendered on an aircraft by the mechanic / engineer is a core consideration for downstream billing efficiency. The ground handling form filled by the mechanic / engineer should have appropriate sections for recording the work performed, type of work (routine / non-routine), time taken to complete the work, materials consumed, ground equipment’s usage and time etc. Equal care should be taken to record the details in the MRO IT system if used offline.

The MRO IT system should have checks in place to ensure that the data required for billing are recorded before the GH (ground handling) Work order is closed. The following table, Tab 2, depicts a few checks and balances in the MRO IT system which will help in plugging revenue leakage

Tab 2: Checks and balances in MRO IT system

Customer invoicing

With the contract set up at the most detailed level and checks in place to record the data of actual services rendered on the Aircraft, the preparation of invoices can be automated with due consideration of all the inclusion and exclusions clauses: ref Fig 3 below.

Fig 3: Automation of MRO invoicing

In the above case, based on the transit check, a fixed price is charged for the transit check. The ground power unit (GPU) is charged for an additional 15 minutes, non-routine is charged on a T&M basis and oil top up as free of cost (FOC) based on the contract. In addition, if the tax applicability for services is set up in the contract, the rates can be applied automatically thereby being ready for submission to the customer.

As the number of flights handled and the customers managed by the line maintenance MRO expands, manual processing of the ground handling forms and calculating the billing amount will not only lead to longer lead times for processing invoices but also will decrease the accuracy of calculations thereby increasing the possibility of revenue leakage. Automated invoice processing through an integrated system improves for speed of invoice processing and also eliminates errors induced due to manual processing.

MRO IT system as enabler for plugging revenue leakage

With carriers outsourcing line maintenance to MRO service providers, the MRO IT system is becoming a critical factor in managing the entire revenue chain. Line MROs using IT systems stand to benefit from automated processing of invoices and improved billing accuracy leading to a reduction in revenue leakages. Even a minor saving by arresting the leakage will have direct positive impact on the bottom line of the service provider thereby increasing their profitability. Given the rigorous nature of current economic times, the need to supplement the revenue growth by plugging revenue leakage has never been more critical than now.

Contributor’s Details

Saravanan Rajarajan S

Saravanan Rajarajan has been with Ramco for the last 11 years. He is a Principal Consultant and Subject Matter Expert in the area of Aviation Supply Chain, with rich domain expertise and diverse implementations experience of rolling out Ramco M&E Solution globally. He holds Bachelor’s degree in Mechanical Engineering and Masters in Business Administration: he also possesses CPIM certification from APICS.

Ramco Systems

With over 60 customers across 24 countries Ramco serves three segments… airlines, helicopter operators and MROs. Ramco Systems provides enterprise solutions built on the firm’s proprietary platform—Ramco VirtualWorks®. All products are cloud architected by design and address the entire business cycle from transaction to analytics

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.