Articles

| Name | Author | |

|---|---|---|

| Next-Gen Airlines, a Digital Business | Ravinder Pal Singh, Chief Information & Innovation Officer, Vistara | View article |

| Data Transition across the aircraft life-cycle and M&E system implementations | Sander de Bree, CEO, EXSYN Aviation Solutions | View article |

| Case Study: MRO Technology Innovations and Learning from other industries | Franco Caraffi, Marine Systems Director, Costa Corporate I&CT, Costa Crociere S.p.A., and Adrian Schmitt, Data Science Team, Lufthansa Industry Solutions | View article |

| Machine Psychology – don’t stop shouting | Soumitra Miraj, Founder of www. InnovativeBinaries.com, and Michael Parsons, Director Travel and Transport Cloud and Data Management Solutions, Oracle | View article |

Data Transition across the aircraft life-cycle and M&E system implementations

Author: Sander de Bree, CEO, EXSYN Aviation Solutions

SubscribeData Transition across the aircraft life-cycle and M&E system implementations

Sander de Bree, CEO at EXSYN Aviation Solutions explains new techniques, to ensure a smooth transition of data from one system to another

One of the more important tasks for airlines and MRO’s today is the usage and management of data and data migration in MRO software implementations as well as, aircraft deliveries. Yes, the latter are of importance, as well.

New Aircraft Deliveries

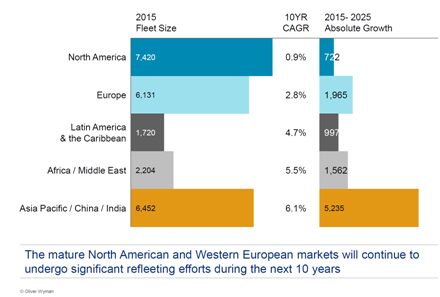

Let’s have a look at the graphic in figure 1 below. On the left, the numbers of aircraft that will be delivered over the next ten years are shown, and on the right what this potentially means for the industry.

Source: Aviation Week MRO Europe 2016 Figure 1

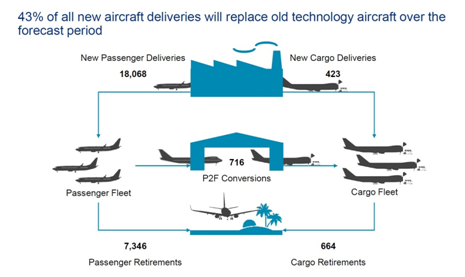

As you can see, there will be quite some data transfer taking place in the coming years. Whenever a new aircraft is phased in to a fleet, huge quantities of data will accompany that delivery. Zooming in even closer we can see that, from those new deliveries, around 43 per cent will replace old technology (figure 2).

Source: Oliver Wyman –Aviation Week MRO Europe 2016

Figure 2

Why does it matter? It means that aircraft with data that potentially sits dispersed around different airlines on paper records, will be taken out of the aviation industry ecosystem and be replaced by aircraft with brand new information coming directly from the OEMs. It also means that the other 57 per cent are brand new aircraft that are being delivered on top of the existing industry; which represents additional data coming in to the aviation sector. These new aircraft deliveries taking place generate an influx of additional data to the industry. This is not the aircraft health monitoring information and on-board data: this is the information needed to manage the compliance of aircraft. Therefore, next to managing data and migrating data during a MRO software implementation, aircraft deliveries will have a huge impact on the data management of the aviation industry.

Before we move to data during the aircraft life-cycle; I want to highlight some things about the importance of data with a few use case examples that we came across during the last couple of years and which both sit on the far end of the spectrum. We then continue with what happens with aircraft data once the aircraft is in operational use? We will focus on how we can manage and migrate all this information from and about aircraft between different MRO systems, between different airlines and look at some specific aspects.

THE IMPORTANCE OF DATA

Let’s first think about the importance of data. As you know, there are a lot of possibilities on the data analytical side: prognostics, monitoring certain things that have real operational benefits. However, that is only possible if there is data available and accessible. We talk about prognostic capabilities, predictive capabilities, data analytics but the reality is that data within the aviation industry is still to a great extent paper-based; aircraft records might be digitalized to a certain extent in MRO systems but are essentially paper-based. All those records hold data that might be of use at some point. So, whenever we are talking about data, one thing that we need to understand is that first of all we’re talking about airworthiness compliance. Data indicates for an airline whether or not particular aircraft are airworthy. That is always the first and most important key consideration when talking about data… airworthiness compliance. Next to that, data is an asset value as well which can be illustrated by two examples.

Wrong inventory; wrong share price

Not that long ago, EXSYN was involved in a data migration project using a specific tool and one of the pieces of information being migrated from one MRO system to another was the inventory of the airline in question. The value of that inventory stood at $1 million. We started to migrate the information to the new MRO software system: however, after all that information had been validated, verified and cross-checked, it turned out that the airline’s inventory was half of the value that they had been reporting up until then. That reporting had been based on data managed in their MRO system. The purchasing manager was pleased, thinking that the reduced inventory value would earn him his annual bonus. However, the CFO was less than pleased because the inventory is reported on the company balance sheet; so, by migrating from one MRO system to another, the airline faced a reduced asset value and consequent reduction the share value – difficult to explain to the board.

Data confirms asset value

Another example that illustrates the fact that data is airworthiness compliance and asset value, is a lease hand-back. When returning an aircraft to the lease company one of the first things the lease company will do is a records verification to check the records that accompany the aircraft including checking data in order to make sure that it is correct. They do that to confirm whether the aircraft is in compliance with airworthiness regulations, which in turn has a direct effect on the value of that asset – no-one would buy an aircraft whose airworthiness is in doubt. So there is a direct relationship between data and asset value and between data and airworthiness compliance.

And, of course, data also helps to identify ways of optimizing maintenance cost, helps to improve reliability, to increase efficiency by means of analytics and it allows users to make predictions about component failures, etc. But foremost, data is airworthiness compliance and asset value.

MRO SOFTWARE IMPLEMENTATION

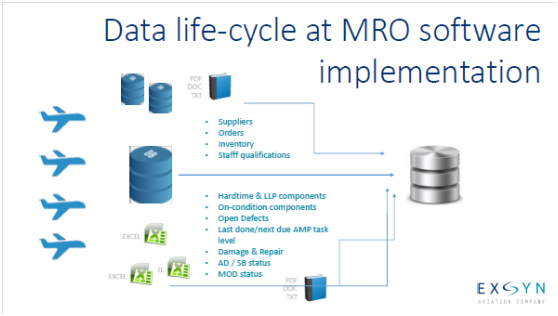

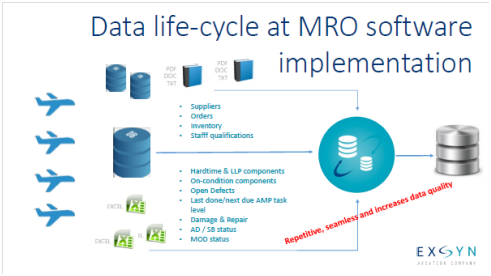

Let’s have a look at something we call data lifecycle at MRO software implementation (figure 3)

Figure 3

Typically, a fleet of aircraft will sit in a particular MRO system (blue in figure 3) and, at some point, the business might decide to upgrade to a better MRO system (silver in figure 3). In an ideal world all that information, all that airworthiness compliance information…

- Hardtime and LLP components;

- On-condition components;

- Open Defects;

- Last done/next due AMP task level;

- Damage and Repair;

- AD / SB status;

- MOD status.

… would be taken from the old legacy system and transferred to the new system being implemented. And because the new system is so advanced it will help in other areas; so some additional organizational data can be transferred as well.

- Suppliers;

- Orders;

- Inventory;

- Staff qualifications.

It will all go into the new MRO system, won’t it?

In reality, we have never encountered a situation where it was this easy. What is more likely is that there is an MRO system in use but there are a couple of Excel workbooks lying around which are more trustworthy than the information in the MRO system: so when it becomes necessary to migrate the complete engine MOD status for an aircraft, we have to use the Excel sheets rather than the old MRO system. Then, it might transpire that the staff qualification is managed on a separate database and the inventory on yet another system while there are even some other records that will need to be transferred. So, in order to have all the data to get the best value from the new system we need to make sure that all of the data from whatever source is identified and made available into the new system. Otherwise the airline or MRO will end up in the same situation it was already in, albeit having a new MRO system.

MRO DATA AT DELIVERY AND RE-DELIVERY

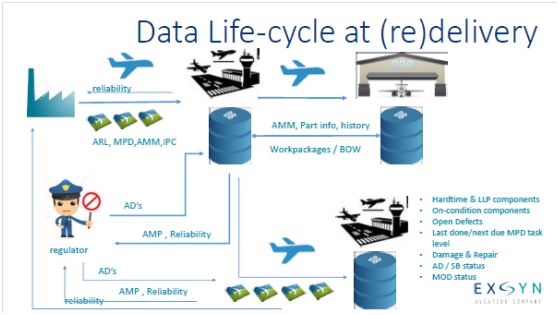

Now let’s look at the same data at the point when an aircraft is being delivered (figure 4).

Figure 4

New from the OEM

An airline buys an aircraft from an OEM; it’s delivered and put into service. But with that aircraft comes a set of data… an aircraft readiness log with all the parts (and their serial numbers) that are installed; maintenance planning documents to use later on to create the maintenance program; manuals and a lot of other information. All of that information can be downloaded and put into the MRO software system to, again, manage the compliance of that aircraft as a primary reason plus, of course, the airline will still want to do analytics, etc.

Regulatory Authorities

In all of this, we cannot forget about the regulatory authorities who will want to be sure that the aircraft also complies with all of their airworthiness directives. So it will be necessary to monitor websites for triggers when a new idea is published to ensure that that new idea can be incorporated into the MRO system. The regulatory authorities need to approve the maintenance program so it needs to be sent to them; they’ll even want to see reliability data for the fleet to assure themselves that things are being done the right way. OEMs also have an interest in receiving reliability data from airlines so that they can improve the aircraft type.

Multiple stakeholders

During the life-cycle of the aircraft, it will need to go for maintenance, potentially with third party maintenance providers who will also be using software systems; so data will be exchanged between airlines and MROs – work packages, bill of works, parts information as well as maintenance manuals. There’s beginning to emerge a picture that spans multiple stakeholders and that’s just for one aircraft. Imagine how that will look for an average fleet of 100 aircraft of different types. All aircraft in a fleet represent data and that data is floating between different stakeholders creating an integration issue.

Re-delivery

What also happens with the aircraft, at some point, is that it will be phased out from service in the airline to which it was originally delivered new but will most likely continue its service in another airline which might be anywhere in the world. So, the airworthiness compliance information for that aircraft has to be available to be transferred with the aircraft from one airline to the new operator and into the MRO system of that new airline. In contrast to the clean delivery from the OEM at the original point of delivery it will now be necessary to deal with the actual status of the aircraft: which components are currently installed on the aircraft because it is likely that, during its life so far, components will have been replaced (new engines, new APU, even new landing gear) and the new owner will want to know the status of those components. There might be open defects; after the aircraft left the factory, new ADs and new service bulletins will have been published, what is this aircraft’s status with respect to those? So, this whole range of airworthiness compliance data is being transferred from one airline to the other together with the aircraft and, of course, in some cases there will be a leasing company sitting between the airlines. Plus, of course, the new owner airline will still need to send reliability and service data to the OEM and to regulators as before.

Over and above all this it’s also important to bear in mind the large numbers of new aircraft that will be entering service and the data flows they will generate. When airlines and MROs are replacing MRO systems this is starting to become a real issue because data, as we’ve said, relates directly to airworthiness compliance and asset value. It’s important to manage that first and then start looking at analytical and prognostic capabilities.

WHAT DOES THIS ALL MEAN?

Throughout the life-cycle of an aircraft, its data flows across multiple stakeholders, M&E systems and sources prior to reaching its end-of-life. This makes data retrieval time intensive for engineering departments for inspections and the like, as outlined above. During MRO software implementations data exists dispersed within the airline in various sources: making standardization and compliance verification a ‘plate of spaghetti’, i.e. all the information might be there but intertwined so that it might only be at the implementation of a new system that we’ll find out if it’s really there and really OK. Data is still airworthiness compliance and, within the next ten years, a substantial amount of new deliveries will replace old tech aircraft, generating an influx of data and making airworthiness compliance even more data driven. Significant re-fleeting will take place in Asian markets for over the next ten years requiring a need for seamless data migration into existing M&E systems. Add to that the development of new software systems and functionalities to leverage the additional data that will be available plus the need to migrate and integrate all this data. In summary, the need for efficient and seamless aircraft data integration and migration has never been higher than it is now. But what can be done?

The answer sits within tools and a tool is a device intended to make a task easier. I’ll give some examples to illustrate this using a tool called TITAN. TITAN is a tool that we have been using at EXSYN for more than five years during data migration and integration and it’s a tool built to merge multiple data sources within an airline, standardize it, clean and validate it before transforming it ready for wherever it needs to go in a repetitive process. Another thing to understand is that the tool has a pre-built library of transformation components allowing the migration of airworthiness and maintenance data from and to many industry known sources such as AMOS, TRAX, SAP, OASES and even mainframe systems which are still prevalent in the MRO sector. There are also some additional pre-built functions to handle OEM provided data from BOEING, AIRBUS, Embraer, Bombardier or ATR and load it into the MRO software system. And one thing that is key to understanding this system and the role it has in the cases that we’ll look at below, is that it contains an industry data warehouse with standardized data which allows us to compare data in the airline against a certain industry standard. In other words, in the current MRO software, there might be the AD status of the aircraft listed and TITAN can compare that against the industry standard definition of those ADs. The data warehouse will also contain up-to-date airworthiness and maintenance data for (amongst others) Maintenance Programs, Parts information, Airworthiness Directives, Service Bulletins, Minimum Equipment Lists, Damage charts and Aircraft Installation records for many different aircraft types. A tool can help with the data migration and integration issue that the aviation industry is already facing.

CASE STUDIES

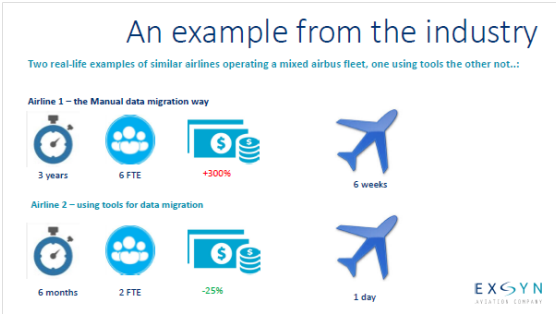

Now let’s look at case studies for two similar airlines operating similar aircraft types and with similar fleet sizes, similar organizations and operating in the same geographical area but with different approaches on the spectrum of how to integrate and migrate data and information between two different MRO software packages. One airline pretty much went the manual route; people locating the information, consolidating it, sitting at a keyboard and typing this information into the new MRO software. The other airline was keen to use migration and integration tools in order to set up the repetitive process that was covered above; merging multiple data sources into one new MRO system.

Figure 5

Let’s look at some key indicators as to how this went (figure 5) starting with lead time, the time it took to take data from where it was previously held, into the new MRO software. For airline 1 going the manual route it took about three years: airline 2 using tools, managed the same process in six months. Also, airline 1 needed six people dedicated to the migration and integration whereas airline 2 only needed to allocate two people to the job. Against the budget allowed for the job, airline 1 overshot by nearly 300%. With the airline that used tools, they came in under budgets by 25% which made resources available to further train their staff for the new system. Both airlines went live with the same new MRO software and started to take on new aircraft from OEMs. Airline 1, doing it manually, took six weeks to implement all the airworthiness compliance data despite the aircraft being brand new. Airline 2, using the same tools, as used for the initial MRO migration took just one day and started to enjoy the benefits of the new system sooner.

THE TOOLS FOR THE JOB

Data migration and integration tools can play a significant role in the aviation industry. The tool sits between the legacy data sources and the new MRO system, collecting all the information from the different sources, standardizing it, validating it, merging it and delivering it to the new system. The real power is its repetitiveness because, once that exercise has been gone through there are bound to be issues on engines, over-runs from AD tasks and a load of other things. But the repetitive nature of the tool takes the effort out of the process, repeating it relatively easily.

The potential at an airline level

Figure 6

As we have already seen, a lot of different stakeholders (figure 6) want information from the airline for particular use cases. The OEM sends the aircraft readiness log with the MPD, the manuals, etc., there is an MRO company undertaking C checks who needs information historic defects, the work packets, the manuals, etc. And there are still the regulatory authorities.

IN SUMMARY

To sum it up, the need for efficient and seamless aircraft data transfer has never been greater than it is today and data migration tools are the answer to that efficient and seamless migration whether implementing a new MRO system or taking on new aircraft or fleets or both. Ease of data management will be required to satisfy a range of stakeholders. Seamless and efficient aircraft data management is key to compliance, cost optimization, efficiency, analytics and predictions.

Contributor’s Details

About the author, Sander de Bree:

Sander de Bree is founder and CEO of EXSYN Aviation Solutions; focusing on engineering and technical management solutions for aviation and specialized in the field of IT systems for aircraft maintenance. As well as implementing the overall strategy he oversees all R&D activities within the company. Sander holds a degree in aeronautical engineering with a specialization in aviation regulations, has a background in business administration and is a member of the Royal Dutch society of engineers

EXSYN Aviation Solutions

EXSYN Aviation Solutions provides aviation IT solutions with one important mission: to develop reliable, simple, and user-friendly software solutions and digital technology so that the aviation industry benefits more from digital possibilities. EXSYN’ s aviation solution platform focuses on data processing, data analytics, data storage as well as related consulting services for Airline Maintenance & Engineering departments. The firm has a broad expertise and a thorough understanding of all the high safety levels to provide clients with a service meeting the required standards and within the timeframe demanded.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.