Articles

| Name | Author | |

|---|---|---|

| eTechLog: Digital trumps paper in the cockpit | Vera Suhova, Project Manager, Conduce Group | View article |

| Column: The World according to IT and me.. Moving Flight Ops content into the 21st century | Paul Saunders, Solution Manager, Flatirons Solutions | View article |

| Case Study: Optimizing Arrival Fuel at Aeromexico | Mike Irrgang, Sr. Aviation Consultant, Professional Services, Boeing, and Rafael Suarez, Sr. Vice President, Flight Operations, Aeromexico | View article |

| Connected Aircraft / Disconnected Airlines: The Future of eEnablement | Captain Michael Bryan, Principal, and Philip Benedict, Principal, Closed Loop, Jay Carmel, Associate, and Sam Dinte, Consultant, Avascent | View article |

Connected Aircraft / Disconnected Airlines: The Future of eEnablement

Author: Captain Michael Bryan, Principal, and Philip Benedict, Principal, Closed Loop, Jay Carmel, Associate, and Sam Dinte, Consultant, Avascent

SubscribeeEnablement is much more than the shiny technology that delivers it say Michael Bryan, Philip Benedict of Closed Loop with Jay Carmel and Sam Dinte of Avascent

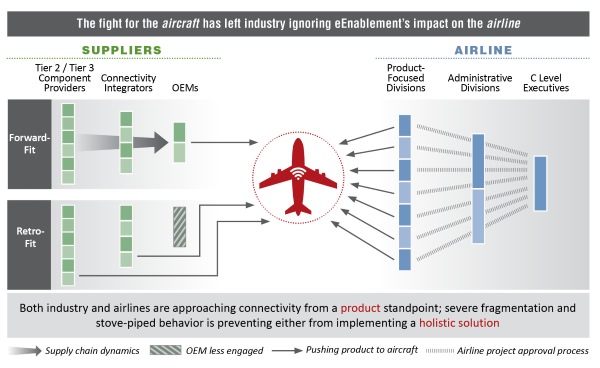

The latest and greatest concept looking to take hold within the airline industry faces an identity crisis. If not resolved quickly, this crisis could compromise billions of dollars in investment and hinder substantial and much-needed efficiency gains for the aviation community; it would ultimately serve as yet another spectacular example of an industry-wide technical initiative gone wrong. The massive influx of new technologies connecting aircraft ‘nodes’ with the broader aviation ecosystem has on the one hand been impressive. Yet with a dizzying number of products and buzz words captivating siloed, ‘technology-first’ airline departments, holistic strategic and business outcomes have been overlooked. Although the full benefits of a holistic airline eEnablement strategy are real, they require considered analysis and disciplined planning to achieve. Among those stakeholders that have tried, failures are all too common. Meanwhile, the fear of failing on such a grand scale has paralyzed many others. Ultimately, eEnablement is an organizational and technical challenge unlike any other initiative that the industry has faced. It will require both airlines and suppliers alike to re-examine ‘business as usual’ in order to deliver the agility and efficiency necessary to succeed in the 21st century.

“Airlines that have not adopted eEnablement strategies within five years will find it difficult to exist.”

Captain Hilmar Baldursson, VP of Flight Operations, Icelandair

The identity crisis

Whether described as ‘The Connected Aircraft’, ‘The Networked Aircraft’, ‘Cabin Connectivity’, ‘In-Flight Connectivity (IFC)’, or the ‘e-Aircraft’ – just to name a few of the popular buzz words – the rapid introduction of advanced IT systems on-board aircraft has made airlines eager for new operational efficiencies and financial gains. In turn, industry has answered with exciting new technologies that improve communications and create mountains of data. Yet for every potential end-user (e.g., passengers, flight crews, airline operations support) and for every aircraft supplier with a component to ‘connect’, there are wildly different organizational imperatives and perceptions of how to actually establish, harness and manage these new data sets and networks.

For instance, aircraft OEMs have been eager to collect data and leverage analytics from the airframe and key systems, in an attempt to offer ‘Big Data’ solutions for airlines. Boeing in fact first coined the ‘eEnablement’ concept back in 2003 during the launch of the 787. Yet today, too many airlines want to turn off ‘Big Data’ because they are struggling to find any intrinsic value in the terabytes of data driving up 787 ACARS (Aircraft Communications Addressing and Reporting System) bills nearly 20 fold. Exacerbating this tension between OEMs and operators, many suppliers focus too narrowly on product-based technologies that ‘connect the aircraft’ and create data, while airline customers have little sense for how to turn data into actionable intelligence. A challenge that remains for all interested parties is to identify, prioritize and then pursue the many compelling strategic and business reasons for ‘connecting the airline.’

This paper argues that eEnablement is not just about connecting new systems, as the OEMs see it. As the name suggests, it is truly about enabling specific outcomes: timelier, better-informed, collaborative decisions, as well as superior operations via the delivery of ‘actionable intelligence’ across the airline. When viewed as a holistic approach with these types of outcomes in mind, eEnablement has the potential to usher in a fundamental shift that the entire industry has sought for a long time.

What is eEnablement?

In its truest form, eEnablement is not just another ‘technology-first’ program like Digital Data and Electronic Flight Bags (EFB) that have come before it. Rather, it is driven by well-defined business outcomes that are part of an overarching strategy for the entire organization. eEnablement is a means to build operational efficiency, capability and financial gain, all via data creation, subscription, analysis, consolidation and value-added capabilities that extend across all airline divisions. A structured process, an understanding of cultural and organizational nuance, and experience are all underlying necessities to extract value from the rapidly expanding data troves available to airlines, both today and into the future.

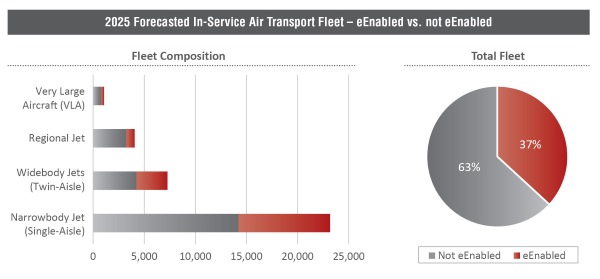

Boeing’s 787 and Airbus’s A350 have, of course, laid the groundwork for eEnablement; yet many operators have begun to realize that operating next-generation aircraft alone does not make an airline eEnabled. It is not only an immense challenge to manage the half-terabyte of new data created every flight, but running these ‘connected’ aircraft alongside ‘unconnected’ legacy aircraft has added significant complexity to airline operations. Despite OEM’s aggressive production schedules, new-build eEnabled aircraft will only represent roughly 35% of the in-service commercial transport fleet in 2025.

New aircraft types and the data they produce, as well as the legacy fleets, cannot exist in isolation if an airline is to reap the benefits of eEnablement. It is entirely possible to create a seamlessly connected fleet, and an eEnablement strategy will allow airlines to realize the value in doing so.

Why does eEnablement matter?

“Airlines that have not adopted eEnablement strategies within five years will find it difficult to exist.” Although Captain Baldursson’s view may be overstated, it underscores the cutthroat nature of today’s airline industry. While growth in air travel demand is responsible for nearly doubling global airline revenues over the last decade, from $379B in 2004 to $751B in 2014 , ever-increasing passenger volumes have overwhelmed airports and airspace. Airlines must now differentiate themselves from competitors through highly efficient operations and exceptional customer service. Despite major advancements in airspace management technologies (including SESAR and NextGen in Europe and the United States, respectively), congested air transport infrastructure is already the norm. By 2034, 7.3 billion passengers are expected to flow through airports, more than doubling the current 3.3 billion passengers that traveled in 2014 . eEnablement will be a critical tool for managing an airline’s response to this demand.

Who benefits from eEnablement?

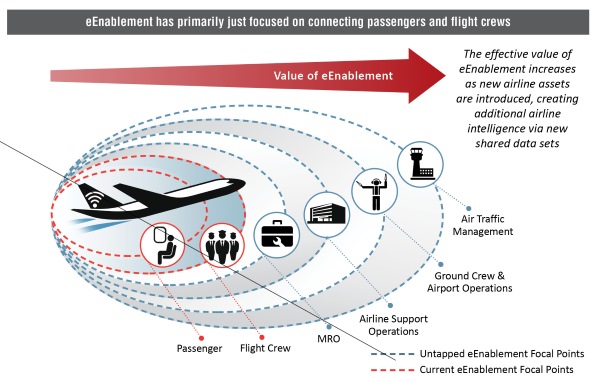

eEnablement is not just about connecting the myriad airline assets and stakeholders, or ‘nodes’, in a network; it is about understanding the relationships among these nodes and how data exchanges among them can add value to operational and strategic outcomes and deliver intelligence. The critical importance of an airline’s relationship with the passenger (or more accurately, the relationship between the aircraft and the passenger) has been clearly illustrated through the prioritization of Cabin Wi-Fi installations. These early In-Flight Entertainment (IFE) initiatives have shaped most perceptions of eEnablement thus far. However, many more airline relationships are poised to benefit under a cohesive eEnablement strategy.

The further that eEnablement programs can extend beyond just the passenger, the higher the effective value of the overall system: that is, the ability to create airline intelligence via new data that is shared amongst and across nodes. Resulting operational efficiencies not only translate to bottom-line improvements, but they also support top-line growth as passenger confidence in the airline improves. However, as each new node is introduced, there often comes a new expectation for what eEnablement should offer and how it should be implemented – reinforcing its overall identity crisis and hampering many audacious programs to date.

Where are we now – and why?

787s versus A350s; Ka-band versus Ku-band; the proliferation of new ‘connected’ aircraft and high-speed networks is increasingly placing eEnablement at the forefront of the industry. However, long-standing norms that drive typical airline, supplier, and project management behaviors have posed challenges for many new eEnablement-related endeavors.

Although many notable project failures embody a combination of all three, the following anecdotes better explain the nuances of each particular issue on its own:

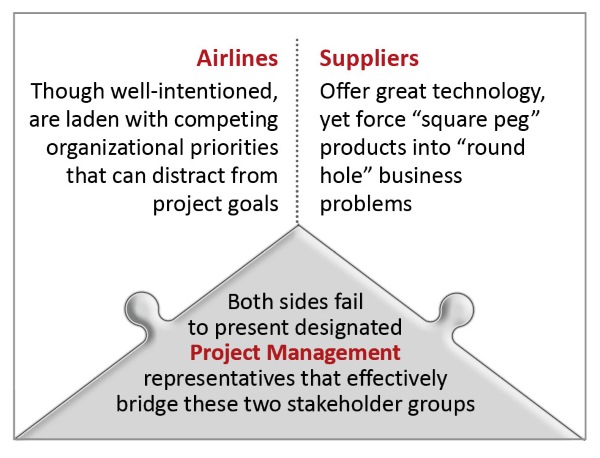

Competing airline priorities

Although critical to the success of an airline, day-to-day functional imperatives at the division level can often overwhelm leadership groups, to the point where separate, uncomplimentary missions are prioritized within each division ahead of collaborative airline goals. At many airlines, for instance, the data-centric nature of operational functions often pits groups like Avionics Engineering against IT for control of programs that connect with the corporate network. Similarly, Flight Operations groups may see eEnablement purely as a tool for connecting the crew, and the crew alone. As all groups focus on hitting respective benchmarks, knowledge is power – and the competition between divisions to regulate the flow of that information is an all too common reason for eEnablement failures.

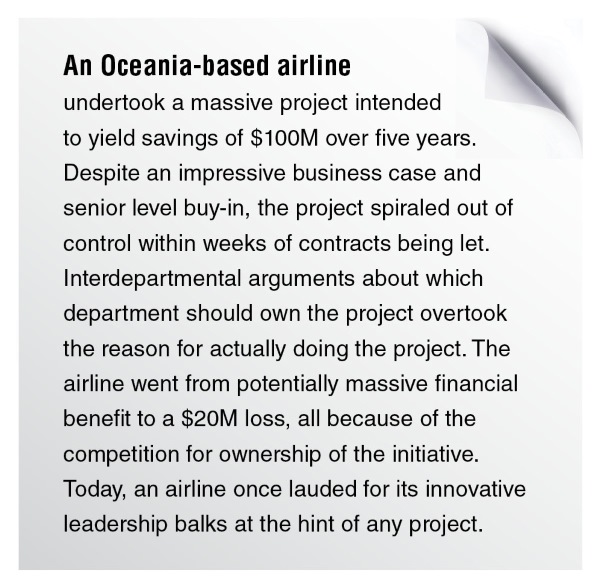

An Oceania-based airline undertook a massive project intended to yield savings of $100M over five years. Despite an impressive business case and senior level buy-in, the project spiraled out of control within weeks. Interdepartmental arguments about which department should own the project overtook the reason for actually doing the project. The airline went from potentially massive financial benefit to a $20M loss, all because of the competition for ownership of the initiative. Today, an airline once lauded for its innovative leadership balks at the hint of any project.

Suppliers’ disconnected planning horizons

Suppliers are equally burdened by their own ingrained set of norms that have compromised eEnablement. Long concept-to-product lifecycles, borne out of rigorous aircraft quality and safety standards, are immensely challenging to work through when many technologies must be developed to meet airlines’ exacting short-term planning horizons. Equipment providers are left to try to read the market and race through development, hoping airlines will catch up and find use cases for technology that has already been invented. In many cases, suppliers with a niche in a specific functional area have developed “preferred relationships” with the functionally-aligned airline department thanks to enticing shiny boxes. These relationships have helped suppliers mitigate against product lifecycle challenges and sustain the top-line; however, using relationships to sell into undefined business problems only reinforces airline divisional fragmentation and may lead to millions of dollars in wasted investment.

An elite Asian carrier decided to execute a revolutionary project that would demonstrate the value of a “connected aircraft.” However, the supplier “hooked” the airline into moving forward with technology, hardware, and product development before full consideration was given to the company-wide operational benefits. After years of failing to define an eEnablement strategy with the products at hand, the massive undertaking was suspended. The airline fell for the “whizz-bang” products, overlooking a more holistic, analytically-driven solution. Although this misstep is not yet financially quantifiable, the outlook is not promising for the airline, the supplier, or by extension, the industry as a whole.

Project management vacuum

A critical consequence of letting “business as usual” attitudes take hold is that overall project management often suffers. Airlines of course recognize that they must innovate or cede market share, while suppliers seek to make a lasting, positive impact for clients. Yet both must contend with chaotic and fragmented day-to-day activities that easily distract management from coordinating on longer-term strategic goals.

A large Middle Eastern carrier’s Flight Operations department embarked on a carrier-wide EFB program at the same time that the IT department had undertaken a broad modernization mandate. Many of the Flight Operations operational needs were overlooked as IT levied its own demands, and all the while a supplier had already been given authority to begin placing EFBs across the fleet. The two stakeholders failed to come together to adequately define a business plan and overall requirements, and spent most of the next seven years playing “whack-a-mole” with the unexpected logjams that arose until the airline had sunk $40M, the EFB supplier’s reputation was questioned, and multiple “project managers” were fired.

Implications

Such failures have detrimental effects on airlines and industry alike. For airlines, wasting hundreds of millions of dollars in capital hampers their ability to compete for increasingly conscientious passengers that demand exceptional service. On the supplier side, poor reputations spread quickly, and relationships can be dramatically tarnished – a major dilemma when faced with very few new-build aircraft to position for. The result is overall risk tolerance decreases to the point where airline executives fail to approve future projects of import, while suppliers’ willingness to innovate is heavily disrupted. Yet despite the litany of consequences that are by now familiar, failed endeavors continue to emerge. Unfortunately, both sides repeat the same approaches in hopes of a different outcome.

Where do we go from here – key recommendations

Improving the success of eEnablement does not hinge on better technology. The wide spectrum of connectivity products available today is already impressive enough to meet airline needs, but gadgets and terabytes of “Big Data” alone cannot deliver the desired outcomes of true eEnablement. New organizational and strategic approaches are needed, where solutions are built around desired business outcomes that are unique to each airline’s market position and operating disposition.

Recommendations for airlines

Airlines themselves must find ways to recognize how each department can contribute holistically to harnessing the potential of eEnablement. This necessitates an open planning process that spans across departments, in which ideas can openly evolve into realistic concepts that provide a return on capital, enable improved operational efficiency, and enhance customer utility. When time to implement, eEnablement teams should be armed with comprehensive market insights that analytically identify “best fit” solutions – as opposed to leaning solely on the technologies thrust upon them. The following set of questions can help airlines begin to think about their readiness for eEnablement:

- Is an overarching organizational strategy for eEnablement in place, based on identified sets of desired operational outcomes?

- Has the airline clearly defined the immediate strategic objectives underpinning that strategy?

- Has the airline selected a quality project management team that is equipped to navigate an increasingly connected operation?

- Is there a notional business case in place to quantify the value of eEnablement?

- Has the airline designated key departments who would contribute to and benefit the most from an eEnablement solution?

- Has thorough market analysis been performed in order to:

- Benchmark the airline against its competitors?

- Evaluate the lessons learned from other eEnablement programs?

- Understand the available technology alternatives?

Recommendations for suppliers

For suppliers, a greater understanding of airline organizational dynamics and airline-wide pain points will help ensure that technical solutions are designed with holistic business outcomes in mind. Often, this will require substantial go-to-market flexibility, both in terms of responding to unique customer concerns identified via robust airline due diligence, as well as through new technology partnerships to ensure that the best solution is brought to bear. The questions below are useful for suppliers as they look to develop more effective go-to-market strategies:

- Has the supplier performed a thorough evaluation of the eEnablement value chain and competitive environment, in order to understand its own position, differentiators, and capability gaps?

- Has the management team fully analysed the customer landscape, in order to identify high-priority segments?

- Has the supplier done proper due diligence on high-priority customer targets, in order to understand how to achieve airline-wide buy in?

- Has the supplier analysed the market for partner or acquisition candidates?

- Is there a dynamic go-to-market strategy in place with a tactical roadmap of business activities that aligns to unique customer needs?

- Has the supplier identified project management leads that can ensure successful customer engagement, program design, and solution implementation?

Call to action

When an airline CFO recently learned that his airline had three different Satellite Communications capabilities originating from three different departments, his bewildered response – “Do we?” – is indicative of the overwhelming need for new approaches to eEnablement. The true operational and financial benefits of an eEnabled aviation ecosystem are still years from being fully realized – yet careful planning must be a near-term priority in order to ensure long-term agility and success.

Contributor’s Details

Captain Michael Bryan

Captain Michael Bryan is a Principal at Closed Loop. He has over 40 years of experience across airline, regional, business and general aviation sectors, currently holds a command on the Airbus A380 and is a qualified LOSA Auditor. He has held various Airline Flight Operations management roles, supporting early EFB implementation programs while also serving as Chairman of various industry working groups.

Philip Benedict

Philip Benedict is a Principal at Closed Loop focusing on customer eEnablement and EFB strategies. With over 30 years industry experience, he previously worked at Jeppesen where he participated in many of their digital data initiatives and was the GM at Spirent Systems, introducing the airborne server and EFB applications at several airlines. More recently Phil was VP of Strategic Development at Teledyne Controls and Cobham.

Jay Carmel

Jay Carmel is an Associate at Avascent. He has supported a wide range of OEMs, niche component providers, and financial sponsors on over 75 projects spanning numerous Aerospace and Defense market areas. Jay primarily focuses on delivering strategic growth, value capture, and M&A support services within the Commercial Aviation sector, leveraging subject matter expertise in aviation connectivity and Air Traffic Management solutions, cockpit and cabin electronics, simulation and training, and aerostructures.

Sam Dinte

Sam Dinte is a Consultant at Avascent. His work has focused on transaction advisory for private equity firms investing in the aerospace and defense space, global market assessments for airborne and ground vehicle clients, and broad strategic engagements related to navigating the federal markets. Sam’s primary focus is commercial aerospace, where he has supported strategic and transactional engagements in the aircraft connectivity, aerostructures, Class C parts, and aircraft interiors sectors.

Closed Loop

Closed Loop Consulting is a niche global aviation consultancy focused on the successful delivery of financially sound, strategically conceived, business driven and sustainable project, program and change outcomes for the operational divisions of the aviation industry.

Avascent

Avascent is the leading strategy and management consulting firm serving clients operating in government-driven markets. Working with corporate leaders and financial investors, Avascent delivers sophisticated, fact-based solutions in the areas of strategic growth, value capture, and mergers and acquisition support.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.