Articles

| Name | Author | |

|---|---|---|

| EASA crackdown on Aviation IT Systems | Sander de Bree, CEO, EXSYN Aviation Solutions | View article |

| Aircraft IT Survey: The Current and Future Aircraft Maintenance Software Market | John Hancock, Editor, Aircraft IT | View article |

| Case Study: TechOps Mexico implements paperless engineering management | Juan Ignacio Lopez, Planning and Productivity Manager, TechOps Mexico and Dr. Hugh Revie, Vice President, EmpowerMX | View article |

Aircraft IT Survey: The Current and Future Aircraft Maintenance Software Market

Author: John Hancock, Editor, Aircraft IT

Subscribe

Aircraft IT MRO Survey 2017: The Current & Future Aircraft Maintenance (M&E / MRO) Software Market

The latest views from the world of MRO IT and what the people who use the solutions are thinking and doing about it

THANK YOU AND CONGRATULATIONS

One of the many aspects of Aircraft IT of which are very proud is the quality of information that readers can access in the white papers from expert vendors in MRO IT, and the peer group case studies. From both, those who have to make a decision can tap into high level expertise focused on the sector in which they work and refer to the real life experience of people who have already gone through a similar process. We also like to provide a platform for the expression of views about what is happening in the market. The Aircraft IT annual survey takes a topical issue of the day to discover what those who do the job of running an airline or aircraft operator think about it. Our surveys build on this by looking at MRO IT with carefully targeted questions to reveal some key messages about this fast growing (in size and importance) aspect of running a commercial aviation business where, these days, IT and technology innovation are becoming routine.

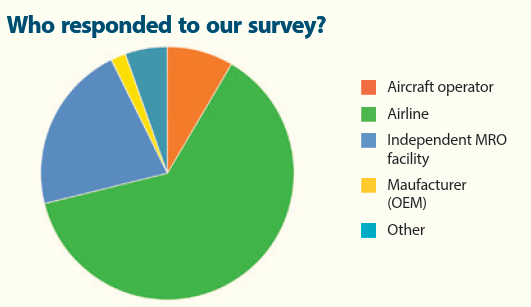

This year’s MRO IT survey looked into attitudes towards solutions and systems used throughout the industry to manage the increasingly demanding business of aircraft maintenance and engineering, and maintenance, repair and overhaul (M&E / MRO). We invited responses from airlines, aircraft operators, independent MROs, manufacturers and other businesses in the sector. The Aircraft IT MRO Survey 2017 was conducted online by Aircraft IT during April and May 2017 and generated 268 completed questionnaires. Aircraft IT collected and compiled the results and Brilliant Truth completed the Data visualisation. So right at the outset we’d like to thank all those who took the trouble to respond and add their experience to the overall results so that readers can add this information to their own library as reference for when they need to consider their M&E/MRO IT solution.

Also, respondents to the survey were entered into a draw with the chance to win an Apple iPad Pro and we’re especially pleased to congratulate the winner in that draw; Pat McGowan, Senior Manager Maintenance Systems Administration, Spirit Airlines. Well done Pat and we hope that the device serves you well.

photo Pat McGowan-sm.jpg)

Pat McGowan, Senior Manager Maintenance Systems Administration, Spirit Airlines with the Apple iPad Pro that he won in the Aircraft IT annual Software Survey Draw

KEY FINDINGS

Key findings

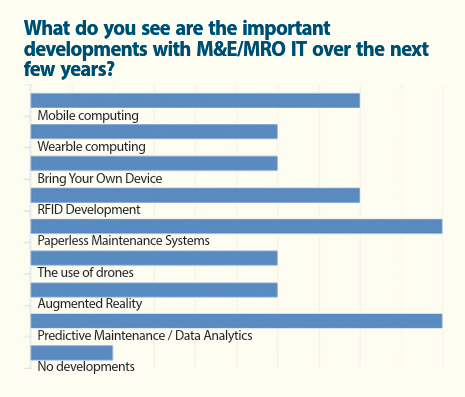

Predictive Maintenance / Data Analytics and Paperless Maintenance Systems are the most important developments required within M&E / MRO IT over the next few years.

- Nearly 63% of responses are from Airlines while nearly 22% came from independent MRO facilities and nearly 2% were from manufacturers. The balance were aircraft operators (nearly 9%) and others (more than 5%)

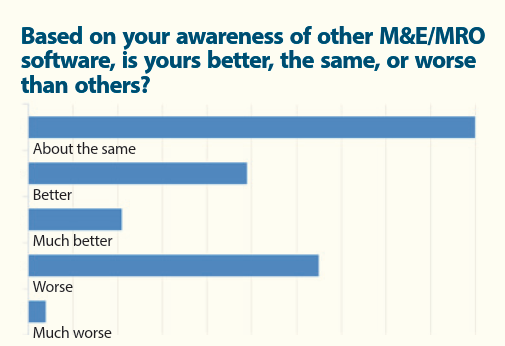

- Over 25% indicated that their M&E / MRO software is worse than others.

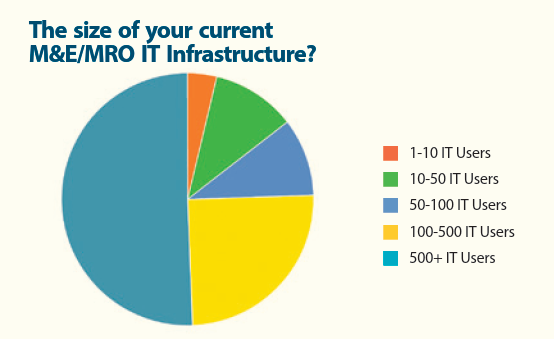

- Over 50% of companies surveyed have over 500 IT users within the M&E/MRO IT infrastructure.

- Over 10% use Excel, Access and other only to manage aircraft maintenance.

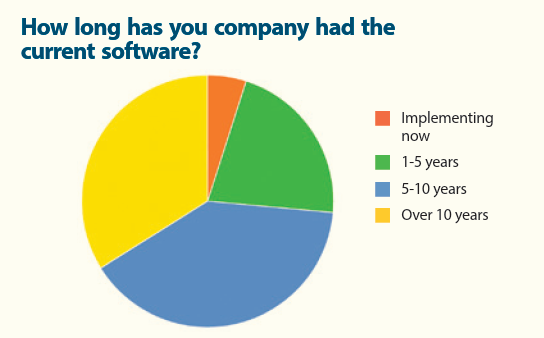

- Over 30% of responses have been using their current software for 10+ years.

A surprise was that more than 10% of respondents still use only MS Excel and Access or other legacy solutions to manage their aircraft maintenance, while over 30% of those surveyed have been using their current software for more than 10 years. It should be a real wake-up call to vendors that more than 25% of respondents indicated that their M&E / MRO software is worse than others. What type of service (or not) must they be receiving? And finally, as a testament to the growing importance of this sector, Over 50% of companies surveyed have over 500 IT users within the M&E/MRO IT infrastructure.

THE SURVEY QUESTION BY QUESTION

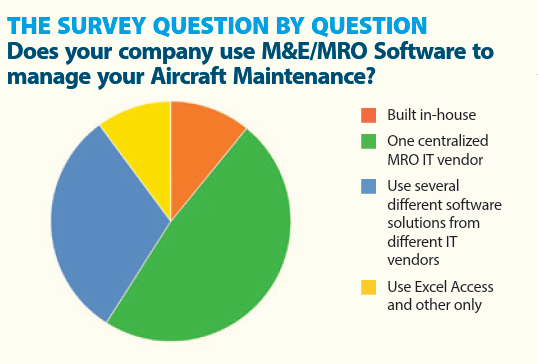

Our first question, other than to establish who was responding to the survey, wanted to gauge the extent to which respondents use M&E/MRO software to manage their aircraft maintenance. Almost the same as in our last survey in 2015, nearly 90 per cent do with just 10.2% still using Excel and Access to do that job. Just under half (48.1%) of respondents use one centralized MRO IT vendor, slightly down from the 51.5% in the last survey, with more than 30% this year using several solutions from different vendors; significantly up from two years ago when that was a little over a quarter (25.6%). The number of respondents using systems that were built in house was 10.9% this year, down from 12.3% two years ago. That suggests that there might not be too many MRO organizations who are uninitiated in the ways of IT and that there is a degree of brand loyalty or, at least, comfort and convenience where one vendor can supply most or all needs.it also suggests that, as the regulatory requirements become ever more stringent, in-house and non-specific software (Excel, Access, etc.) are not really able to cope.

For all respondents, we wanted to know the size of their current IT infrastructure and it was a sign of the times and the importance of IT for today’s organizations that just over half (50.6%) have more than 500 people using M&E / MRO IT – up from 46.5% two years ago. Add to that, a further quarter (24.9%) who have between 100 and 500 IT users and it can be seen that three quarters of respondents have IT infrastructures with over 100 personnel: a mark of how important this now is. With 10.0% between 50 and 100 (almost no change from two years ago) and 10.8% between 10 and 50, down from 14.3% two years ago there seems to be a steady increase in IT infrastructure size. Just 3.7% have less than ten IT users. Of course, much of this variation might reflect relative sizes of the respondent organizations and the gradual consolidation of the sector with mergers and take-overs.

Whatever software is being used, we also wanted to establish how long people have been using it? The 33.9% who have been using their current software for more than ten years shows almost no change from the figure two years ago, 30.9%. The 39.7% per cent who have been using their solution for five to 10 years has hardly changed from the 39.5% recorded two years ago. For nearly three quarters of respondents, IT is an established component in their M&E / MRO organization and process. 21.5% of respondents have been using their current software for between one and five years, down from 24.1% last time while the remainder (5.0%; down from 5.5% two years ago) are in the process of implementing a solution now. IT remains a well-established part of any M&E / MRO business which, given the complexity of modern aircraft and regulations, should not come as a surprise. It would seem that, for most M&E / MRO organization, the decision is still not whether to use IT but rather which solution can best match their requirements and whether to opt for the relative comfort of staying with the vendor who knows them well or the perceived potential for disruption in moving to a new software solution.

Last time we asked respondents how satisfied they were with their current solution. We’ve slightly changed the question this time around to ask them, based on their awareness of other M&E / MRO software, is theirs better the same or worse than others? A clear majority thought that the software they are using is ‘About the same’ as others with smaller but equal numbers finding their software better/much better or worse/much worse than others. While the better/much better group is not so surprising and perhaps reflects our natural affiliation with the familiar as well as the quality of IT solutions today, the fact that as many respondents consider their software worse or much worse than others must reflect either real qualitative differences between solutions or poor customer service and training efforts on the part of some vendors.

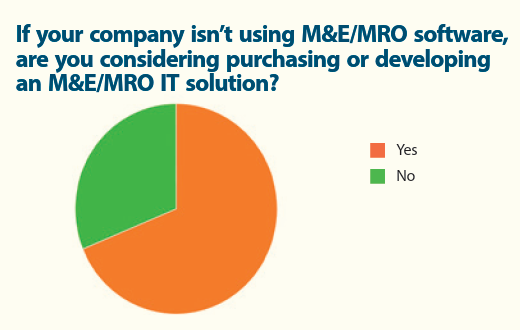

In our survey two years ago, we asked those respondents whose company doesn’t have an M&E / MRO IT software solution, what are the major reasons for that? This year, we preceded that with a more straightforward question, ‘If your company isn’t using M&E / MRO Software are you considering purchasing or developing an M&E / MRO IT Solution?’ The answer was commensurately clear. Nearly 70% of respondents in this group are considering purchasing or developing a solution while just over 30% are not. That is, perhaps, the most surprising insight inasmuch as it is becoming increasingly difficult to imagine how any aviation business could be run without IT…

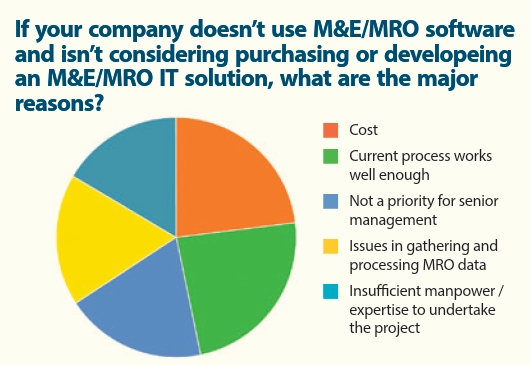

… so following on from that, we wanted to know, as in the last survey, for those respondents whose company doesn’t have an M&E / MRO IT software solution and isn’t considering purchasing or developing one, what are the major reasons for that? As in the previous survey, the variations were not great with the largest group of these respondents (23.7%) being of the opinion that their current process works well enough. The next largest group (23.0%) this survey down from 23.6% last time) cited cost as the main reason. Perhaps a little more concerning, the 19% who reported that it was simply not a priority for senior management was up, albeit slightly, from the 18.1% who cited this reason two years ago but only 16.5% (down from 20.8% in the last survey) felt that they had insufficient manpower or expertise to undertake such a project while an almost unchanged 17.8% (17.6% last survey) reported issues with gathering and processing MRO data.

LOOKING AHEAD

Whether or not a business is planning to change its software solution in the foreseeable future will depend on a number of factors. Many of those will be internal as the organization grows and, possibly, the fleet expands to handle increasing volumes of work over a growing route network. There will also be the consideration of next generation aircraft that are entering the fleet as well as current generation aircraft upgraded to the latest digital standards; plus, a slowly diminishing legacy fleet of aircraft from the previous generation that will still be in fleets and cascading down to smaller carriers over time. Even if they’re old technology by today’s standards, the aircraft still represent significant assets which must earn their return. Imperatives driven by corporate developments such as mergers and acquisitions or the need for MRO IT to be able to work with other solutions in the enterprise in an increasingly integrated IT environment will also be influential. But much need for change will be driven by new opportunities in the sector itself.

With this in mind, our penultimate question of the survey was to ask what respondents saw as the important developments in M&E / MRO IT over the next few years and, in this, respondents were able to offer multiple answers. Reflective of the pace and extent of change in M&E/MRO IT, we increased the number of options available from six to nine. Of the two highest ranked developments in the last survey, Paperless Maintenance Systems stayed at the top but Mobile computing fell back to joint third. The other equal most anticipated option was a new one, Predictive Maintenance / Data Analytics. Mobile computing has this year shared its popularity as joint third most anticipated development with RFID Development. Four developments share the next level of anticipation; Wearable computing and Bring Your Own Device from the previous survey rank alongside two new technologies, The Use of Drones and Augmented Reality, in terms of what respondents saw as the next most important developments in M&E/MRO IT over the coming few years. Again, very few respondents expect no developments. This part of the survey certainly reflected the very exciting world of work in which readers now operate.

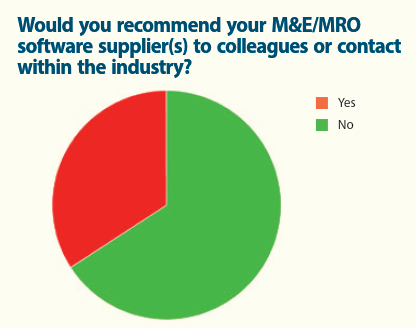

Following on from but slightly different to the earlier question, ‘Based on your awareness of other M&E / MRO software is yours better the same or worse than others?’ we also asked respondents whether they would recommend their M&E/MRO software supplier(s) to colleagues or contacts within the industry. A majority, 65.8% said they would but a significant minority, 34.2% said that they wouldn’t. So a number of vendors have some work to do on their customer relations and/or understanding what their customers need.

CONCLUSION

We’ve seen it in all of the material sent to us at Aircraft IT MRO and readers will have been aware of the regular flow of innovative solutions to long standing challenges and requirements as well as the capabilities that did not previously exist and that exploit the amazing levels of data and analytical possibilities now in play. And there is no sense that the speed of developments will diminish any time soon.

Readers will be able to keep up those developments as they happen by going to Aircraft IT MRO website or reading the Aircraft IT MRO eJournal.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.